Last Thursday, The Supreme Court ruled the Affordable Care Act as constitutional. In the days that have followed, some have rejoiced in victory and others have contested the ruling in anger. However, everyone is asking one salient question, “What does this mean for my future healthcare costs?”

If you’re a small business owner (which includes franchises), you’re probably particularly concerned with the potential added costs of the Affordable Care Act. Do you have to provide healthcare for your employees? If you’re an employee of a small business, you’re probably also concerned. Does this mean that you’ll lose your job? Or, will you be asked to work part-time hours so your employer can opt out of paying for your health insurance?

First of all, here’s a breakdown of what the law requires. For more detailed information, head here.

- If you own/operate a business that employs 50 workers or less, you will not be required to provide healthcare coverage because you are considered a small business by the Affordable Care Act.*

- If you own/operate a business that employs more than 50 workers, you will not be required to provide healthcare coverage. However, beginning in 2014, employers that do not provide adequate health insurance will be required to pay an assessment if their employees receive premium tax credits to buy their own insurance. These assessments will offset part of the cost of these tax credits. The assessment for a large employer that does not offer coverage will be $2,000 per full-time employee beyond the company’s first 30 workers.

- If you are self-employed with no employees, you will be required to purchase health insurance or pay a tax equal to 2.5 percent of your household.

Last Friday, The International Franchise Association conducted a survey of nearly 200 franchise owners, operators and executives. Asked if they’re more or less likely to hire based on how the Supreme Court ruled last Thursday, of the 200 survey participants 85 percent said they would be less likely to hire. Fifteen percent said they would be more likely to hire.

At a separate time but in tandem with the IFA, The Hudson Institute conducted a study that suggests 3.2 million jobs at franchise businesses remain at risk as a result of the employer mandate provision of the healthcare law.

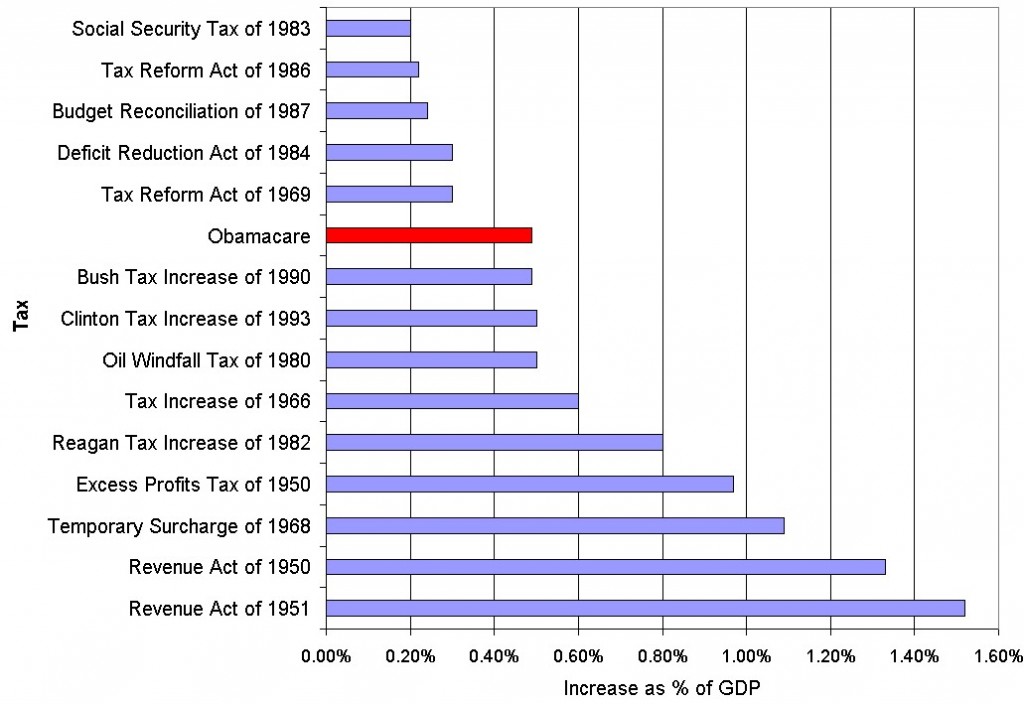

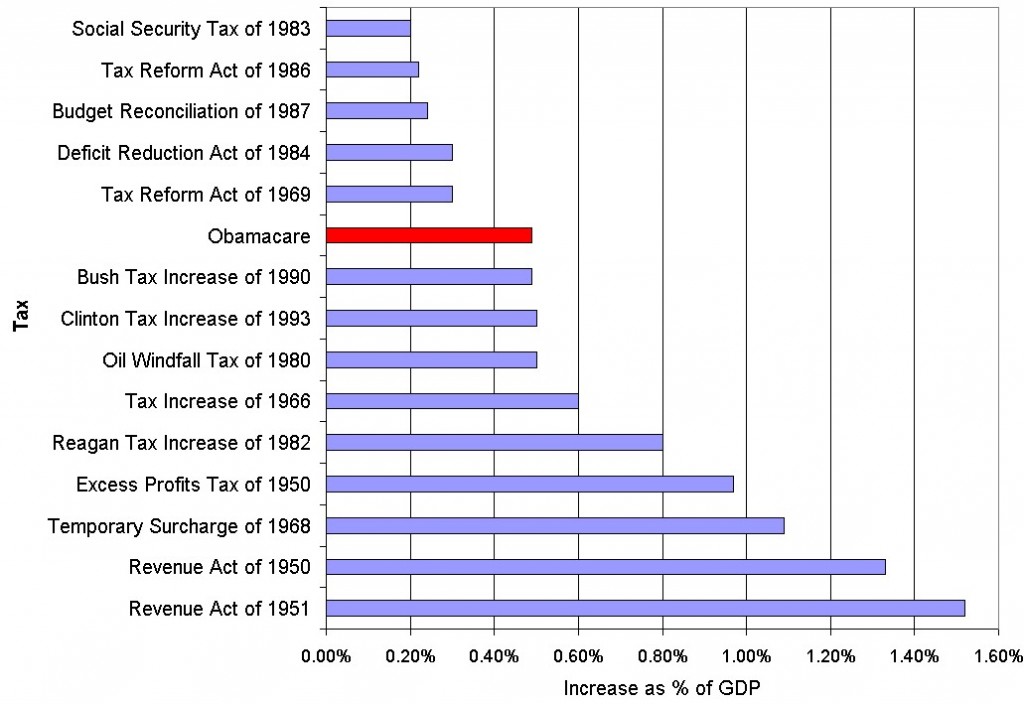

In a recent Washington Post piece, FASTSIGNS chief executive officer, Catherine Monson, called the law “truly unworkable and unaffordable for our country’s small business owners.” Monson lampooned the Affordable Care Act, saying that it is “one of the largest tax hikes in U.S. history,” one that comes at the expense of small businesses, and will ultimately impede growth at a time when our country needs it most.

Just to be clear, the Affordable Care Act isn’t one of the largest tax hikes in U.S. history. Presidents Bush and Reagan both introduced tax increases larger than Obamacare.

That said, the law does include a number of tax hikes:

- $27 billion : the amount the individual mandate will raise during the next decade.

- $30 billion: the amount the tax on unusually expensive health insurance plans will raise during the next decade.

- $60 billion : the tax on insurance companies

- $200+ billion : the amount the largest tax increase in the law comes from high earners, who will see Medicare payroll tax increase by 0.9 percent

“Bottom line: the law will deter growth by unintentionally discouraging franchisees from owning and operating multiple locations, creating a competitive disadvantage for our franchisees who do own more than one or two locations (and who may want to open additional stores), and barriers to entrepreneurs who are looking to capitalize on the franchise business model to grow their business and hire more workers,” writes Monson.

What do you think about the Affordable Care Act? Is universal healthcare something that the United States needs to embrace? Or, is it a hindrance to job growth?

*If you own/operate a small business that employs 25 workers or less, you will not be required to provide healthcare coverage. However, the government offers subsidies for small businesses with less than 25 employees who make less than $50,000 annually. A tax credit to defray 35 percent of the cost of healthcare will be given to for-profit companies; a credit of 25 percent to not-for-profits. In 2014, those percentages will rise to 50 percent and 35 percent, respectively.